COVID-19 Resources for Entrepreneurs

We are updating this page as new resources become available

- Business Recovery Fund:

- The Business Recovery Fund is a microloan program intended to provide existing businesses in the City of Charlottesville and Albemarle County with funds to restart operations once the COVID-19 pandemic subsides. CIC will administer the loans as part of our microloan program. The fund will offer microloans up to $10,000.

- For more information, visit: Business Recovery Fund

- Small Business Development Center:

- Unemployment Update

- CVSBDC website- please continue to check back for updates

- Grants Available for Female and Veteran Owned Entrepreneurs

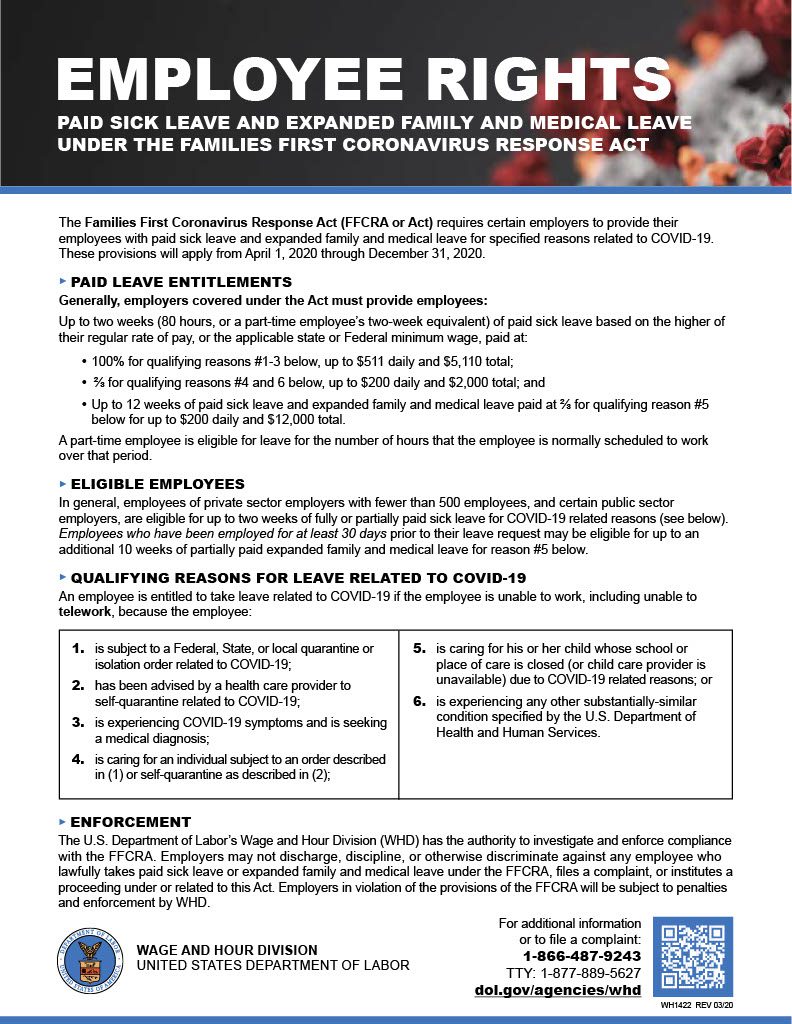

- Updated Federal Stimulus Information:

- TurboTax has partnered with the IRS to help speed up the delivery of stimulus payments to people who aren’t required to file tax returns. Please go to the “stimulus registration” page to submit your direct deposit information.

- IRS Webpage with information related to the CARE stimulus package

- Forgivable Loans for Virginia Small Businesses:

- US Small Business Administration:

- *CARES Act New Updates* (download the guide)

- Payroll Protection Program

- If you are interested in this program please contact your bank immediately to see if they are going to be a lender in this program.

- Disaster Loan Assistance

- *EDIL below does have a possible grant opportunity. When prompted please selected yes to the “loan advance”.

- Information on VA Specific Policies

- Virginia Unemployment Commission Resources:

- KIVA Loan Program Opportunities:

- Mental Health Resources:

- Charlottesville Area Businesses who are hiring:

- Information on tax filing deferment:

- Deferred filing for FEDERAL TAXES

- Virginia Taxes still Due

- Restaurant Information:

- Facebook Grants Program:

- US Black Chamber of Commerce:

- Financial Resources:

- How to Negotiate with a Landlord:

Tips for managing your business during COVID-19

Practical Advice for Startups and Businesses to Persevere an article written by Tracey Greene, CAN Founding Executive Director, CBIC Executive Director

Retail stores:

- If you are going to close your store, do it earlier to minimize burning cash unnecessarily.

- if you are staying open, only be open when you’re most busy traditionally

- Eliminate all non-essential spending that does not result in immediate cash return.

Marketing/Customer Relations:

- Do not spend money on marketing unless there is something tactical that drives cash.

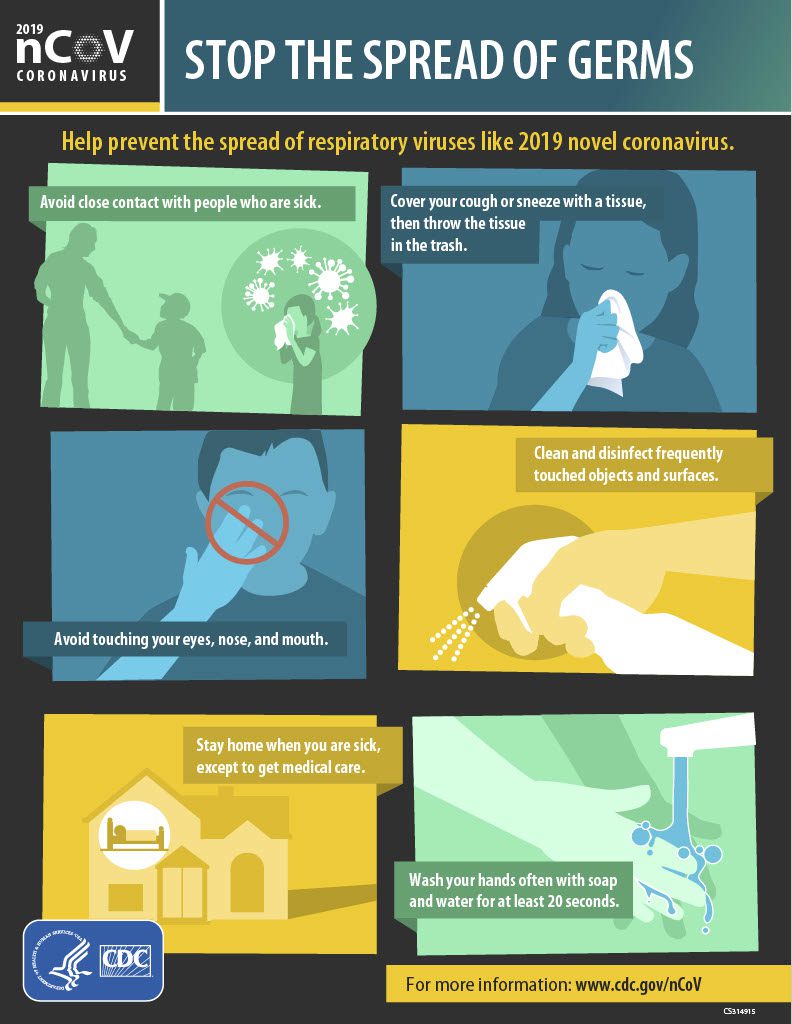

- Protect the brand in all decisions. Do not put your customers and; therefore, your brand at risk.

- Preserve customer relationships – they are concerned and want to hear from you.

Personal Spending:

- Call your landlords immediately. They know the risk of losing all their retail partners and they should be able to consider long term options. Think in terms of three month time periods minimum. Be creative to support each other.

Finances:

- If your loan is tied to your other accounts have a conversation with your lender. If autopay is on, consider whether or not you make monthly payments in full or make minimum payments.

- Look at SBA disaster loans and other state and federal options as things evolve

- Complete cash flow planning—fundamental to know when things need to be shut down. Consider 6-12 months.

Insurance:

- Get on the phone with your broker asap. Most policies are not designed to address this situation. However, some do have business interruption insurance that specifically mentions a virus or pandemic. Check your insurance.

- Insurance brokers recommend make a claim for business continuity or business disruption payments REGARDLESS as they may approve disruption claims.

- Immediately change your workman’s comp. policies as number of employees working changes. Think about this as it relates to all insurance policies.

Modifying Businesses/Changes Based on Social Distancing:

- Control inventory very carefully

- Stay in touch with customers

- Change model to takeout and delivery

- Flagging parking lots to make pickup easier

- Discounted takeout menus

- 3rd party delivery

- Adding phone lines

- Get more paper products and takeout containers

- Sell gift cards

- Staff considerations

- health and safety

- wages

- converting FOH to delivery drivers

- family needs

- provide staff with all unemployment information

- help by giving them meals and food to take home

- Pay your payroll taxes or file for an extension